Aggregate demand.

Aggregate demand is the total demand for a country’s goods and services at a given price level (the average of each of the prices of all the products produced in an economy) and in a given time period.

It is made up of consumer expenditure _C_(spending by households on consumer products), investment _I_ (spending on capital goods), government spending _G_ (spending by central government and local government on goods and services), net export (exports _X_ minus import _M_)

So we have a formula of aggregate demand:

AD = C + I + G + (X – M)

So lets have a look on the components of aggregate demand.

Consumer expenditure (consumption)

There are some things that can have influence on consumption:

- real disposable income. This is the main influence on consumption. If people have more income they spend more, if they are poor they spend less. This can be measured by average propensity to consume (APC). The formula: spending/disposable income.

- wealth. Everything that people own ( houses, cars, assets, shares, money in a savings account, etc.) is wealth. It’s very simple to understand. For example, people who have more property or more savings in their accounts will be willing to spend more.

- consumer confidence and expectations. When consumers are filling optimistic about their future and they also are waiting for increasing their wages, they spend more money.

- the rate of interest. It is important influence on consumption. Firstly, interest rate is the charge for borrowing money and the amount paid for lending money. For instance, if rate of interest fell, people would borrow more money, thus, they would spend more. But for people who save money for borrowing (net savers) a fall in rate of interest has negative sequels, because they will earn less by lending money than they could before a fall in interest rate. So their spending will reduce. Usually, a fall in spending of net savers bigger than a fall in spending of ordinary people. That’s why a fall in interest rate can be often a cause of decreasing in spending.

- the age structure of the population. As we know the young and the elderly spend a high proportional of their disposable income, because these groups of people don’t earn a lot, they usually spend more than their income.

- distribution of income. It shows how income is shared out between households in a country.

- inflation. It is a sustained rise in the price level. So, if there is inflation in the country, people are waiting for increasing in prices, thus, they will spend more now (spending will increase).

Talking about consumer expenditure we can also pay attention on saving.

Saving is real disposable income minus spending.

Here is a list of things that have influence on saving:

- real disposable income. It is measured by average propensity to save (APS). Formula: saving/ disposable income.

- the rate of interest ( not a rate of borrowing!). If it increases people will save more. There is also group of people who save with a target figure in mind. They are target savers. In their case high interest rate would reduce the amount they have to save.

- confidence and expectation. Households and firms are likely to save more if they are not certain about their future. Fro instance, if people expect losing their jobs, they will save more.

- saving schemes. Some saving are contractual (when people agree to save a certain amount on regular basis in insurance and pension schemes).

- range of financial institutions. If financial system in the country is stable and developing, people will trust more financial institutions, so they will save more. But sometimes when financial system becomes more developed people will find borrowing money easier so they will save less.

- government policies. If the government introduce tax-free saving schemes people will save more.

- the age structure of the population. Yong people don’t usually save money. People often start to save in middle age. They save money for their retirement. In developing countries (effective economic system) it is very popular to save money for pension (after retirement) age.

Investment

The main reason of investment is rewards (for example, percentage of the company). So investors are looking for some factors when they are making decision about investment to make the highest profit. So, what actually can influence on investment:

- changes in real disposable income. Usually, if income increases, demand will increase. So it is likely for firms to invest in this period. But they have to know that with increasing demand they have to supply more to avoid a highly increase in price. So they will have to invest more.

- expectations. Firms are likely to invest more if they are optimistic about their future.

- capacity utilization - the extent to which firms are using their capital goods. Firms are likely to invest more if the have currently operating close to full capacity.

- current profit levels. High profit level encourage firms to invest more and also encourage firms to be optimistic about their future.

- corporation tax. This is a tax on firm’s profits. If this tax increases firms will invest less. In contrast, cut in corporate tax would encourage firms to invest more.

- the rate of interest. Interest rate has high influence on investments, because firms, that invest money into the market, depends on changes in particular market. Changes in interest rate will cause changes in the market ( interest rate rises – people spend less, etc.)

- advances in technology. With new technologies production always develop. If firm will involve new technology in production they will, probably, spend less money on producing, so their profit will increase. We can say that new technologies encourage firms to invest more.

- price of capital equipment. It is very simple. Cheaper equipment – more firms are able to buy – more firms are willing to invest.

Government spending.

Lets have a look at first on two definitions: Real GDP (the country’s output measured in constant prices and so adjusted for inflation) and GDP (the total output of goods and services produced in a country).

Factors, which have influence on government spending:

- the government’s view on the extent of market failure and its ability to correct it.

- the level of economic activity in the economy. For example, if it is a high level of unemployment government can increase spending to increase aggregate demand and national output.

- a desire to please the electorate. The government can spend money on education, health, etc. to prove to their voters that their government works efficiency ( also to attract more people for next election)

- war, terrorist attacks and rising crime, or their threat, can also increase government spending.

Net exports.

Factors which have influence on net exports:

- real disposable income abroad. A rise in income abroad is likely to result in more exports being sold.

- real disposable income at home. In contrast, a rise in income at home can result a fall in export, because some firms can change their selling policy and sell products at home because they will be certain about demand at home.

- the domestic price level. The value of exports can fall and a value of imports can increase if the domestic price level rises relative to the price levels in the partner-traders countries.

- the exchange rate. It is the price of one currency in terms of another currency. Exchange rate is very important in international trade. SPICED. If exchange rate goes up (for instance, pound) import prices will be cheaper, export prices will be more expensive.

- government restrictions on free trade. The government can provide special payments for imports. It is called tariffs. For example, if you want to sell

The relationship between aggregate demand and the price level.

So lets have a look on diagram below.

As we can see that x-axis is Real GDP (GDP after inflation) and y-axis is Price Level). The aggregate demand curve slopes down left to right. There are three effects, that explain this:

- the wealth effect. This relates to changes in households’ and firms’ wealth.

- the rate of interest effect. A rise in the price level means that some people will sell financial assets, such as government bonds (a financial asset issued by the central or local government as a means of borrowing money)

- the international trade effect. A rise in the price level will make international product less competitive, so export will decrease, and people also will start to buy more import. As a result it will be budget deficit (import is greater the export), so demand will contract.

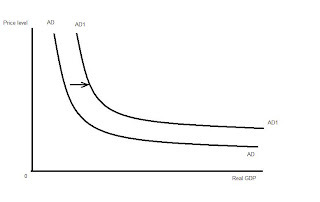

Shifts in aggregate demand curve.

On the diagram below we can see an increase in aggregate demand. There are a lot of reasons of this (we have talked about it before).

Aggregate supply.

What is it? It is the total amount that producers in an economy are willing and able to supply at a given price level in a given time period.

On the diagram below we can see a varying elasticity along an aggregate supply curve. This diagram (from points O and Y) shows situation with a high level of unemployment and low output ( AS is perfectly elastic)

The main causes of changes in AS in the short run are changes in the costs of production. On the figure below we can see that AS decreases, because of increase in the cost of production, for instance.

Increasing in AS can also be caused by increasing in labour productivity (output, or production, of a good or service per worker per unit of a factor of production in a given time period.). Diagram below shows the productive capacity of the economy increasing.

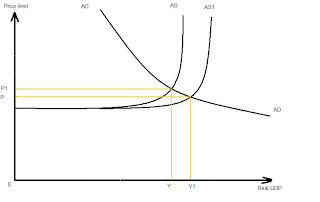

Macroeconomic equilibrium.

Macroeconomic equilibrium occurs in situation where aggregate demand (AD) equals aggregate supply (AS) and real GDP is not changing.

Example of macroeconomic equilibrium in the point P,Y:

The circular flow of income.

The circular flow of income shows show us how the whole economy works and how changes AD. On the picture below you can see diagram of the circular flow of income.

Factor services – the services provided by the factors of production.

Leakages – withdraws of possible spending form the circular flow of income.

Injections – additions of extra spending into the circular flow.

Multiplier effect...

Is the process by which any change in a component of aggregate demand results in a greater final change in real GDP.

The diagram below shows the increase in AD of 5 billion pounds and the final increase in AD of 15 billion pounds. The main thing of multiplier effect that government has to recognize is that any change in government spending or taxes will have a knock-on effect on the economy.

Changes in aggregate demand.

An increase in aggregate demand raising the country’s output but leaving the price level unchanged.

An increase in aggregate demand raising both the country’s output and its price level

An increase in aggregate demand raising the price level but having no effect on the country’s output.

Changes in aggregate supply.

An increase in aggregate supply increasing the country’s output and lowering the price level.

An increase in aggregate supply raising potential output but having no effect on the country’s output or price level.

Changes in AD and AS.

An increase in aggregate supply matching an increase in aggregate demand.

AD growing more rapidly than AS. This diagram also shows an economy overheating( the growth in AD outstripping the growth in AS, resulting in inflation)

Output gap.

Output gap – the difference between an economy’s actual and potential GDP. It can be positive and negative.

Positive output gap (actual output is above potential output)

Negative output gap (actual output us below potential output)

You have deleted my comment without correcting your mistake...

ReplyDeletewhich comment?

ReplyDeleteSaying that you had an important mistake....(clue: deficit)

ReplyDelete"As a result it will be budget deficit (import is greater the export), so demand will contract."

ReplyDeleteMISTAKE